The Good Opportunities Fund is GFl’s pooled fund offering

The Good Opportunities Fund is our alternative strategy fund that is available to accredited investors.

Typically invested in 15 to 20 core holdings, the Good Opportunities Fund is a long/short pooled fund that employs the same rigorous investment standards as GFl’s customized portfolios.

The Fund strives to identify compelling long and short investments and combine them into a concentrated best-in-class portfolio.

GFI relies on thorough research to evaluate potential investments. The Fund generally holds a limited number of investments each accounting for a meaningful portion of the portfolio. We therefore only put capital to work in opportunities we deem worthy.

GFI is also prepared to short, or bet against, various businesses when they lack the qualities that we seek. The short opportunities that we focus on have significant obsolescence risk, while typically coping with significant amounts of debt.

The aforementioned characteristics are not simply a marketing tool; they are the foundation of our investment methodology.

GFI also works with qualified investment advisors.

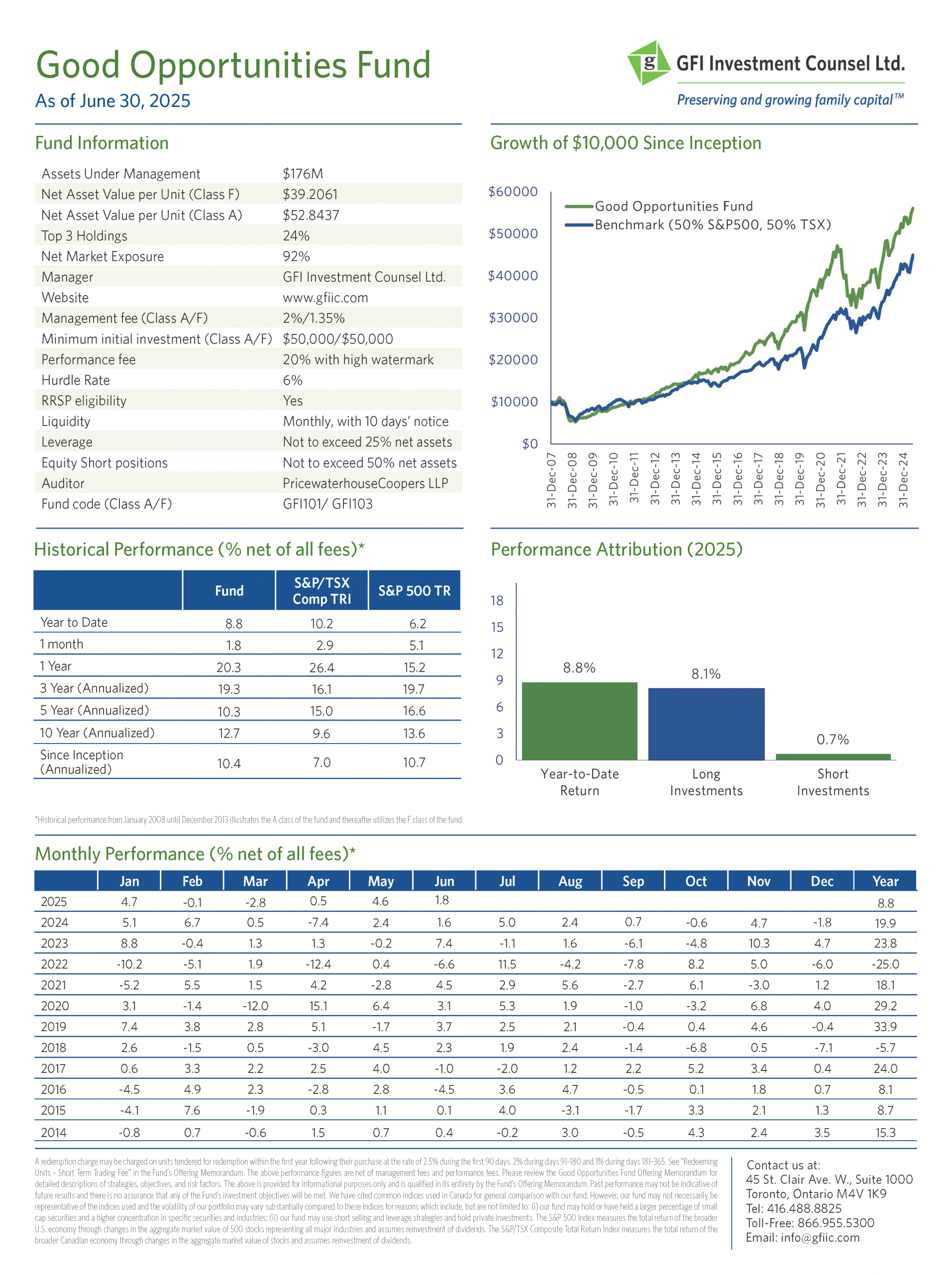

Good Opportunities Fund Performance (March 31, 2025)

The following is the historical performance of GFI’s Good Opportunities Fund. Please speak to us today at 416-488-8825 to learn more about our Good Opportunities Fund.

| YTD | 1 Year | 3 Year* | 5 Year* | 10 Year* | Inception (1/1/2008)* |

|---|---|---|---|---|---|

| 1.7% | 8.3% | 9.2% | 14.1% | 12.1% | 10.1% |

*Annualized

Good Opportunities Fund Fees

| Management Fee – Class A | 2.00% |

| Management Fee – Class F | 1.35% |

| Performance Fee | 20% |

| Hurdle Rate | 6% |

| Perpetual High-water Mark* | YES |

*The highest Net Asset Value (NAV) of a fund is known as the “high-water mark.” The manager will not receive a performance fee unless the current NAV is above the highest historical value.

A track record of performance

We’re proud of our performance numbers, updated quarterly.

GOOD OPPORTUNITIES FUND

WINNER OF THE 2019

CANADIAN HF AWARDS

Overall Best Hedge Fund

GOOD OPPORTUNITIES FUND

WINNER OF THE 2020

CANADIAN HF AWARDS

Overall Best Hedge Fund

GOOD OPPORTUNITIES FUND

WINNER OF THE 2021

CANADIAN HF AWARDS

Overall Best Hedge Fund

Please note that the Canadian Hedge Fund Awards are entirely quantitative, based solely on performance data collected and tabulated by Fundata Canada.

We look for securities that we understand, issued by companies we can comfortably evaluate.

DANIEL GOODMAN